Car insurance is very important for your car if you have a car. Car insurance rates can be expensive. So you need to know beforehand how to compare car insurance rates and how to compare car insurance quotes. It’s one of the most important aspects of auto insurance. Without it, you could be fined or even arrested for operating a vehicle without proper insurance.

However, knowing where to begin looking for the best rates and coverage can be challenging. Many companies offer different rates, benefits, and discounts to entice customers to buy their product over another.

If you have no idea about all these things in the right way, read this post carefully. We have discussed in this post how I can compare car insurance quotes and where I can compare car insurance, and we have also discussed many other important things that you need to know.

About Car Insurance Rate

The price of car insurance can vary depending on the driver’s age, location, and vehicle type. Rates for younger drivers are typically lower than for older drivers, and rates for rural drivers are often lower than for urban drivers. Rates also vary based on the make and model of a car. Several online insurers can get a free estimate of your car insurance rates.

How to Compare Car Insurance Rates?

When looking for car insurance rates, it can be hard to know where to start. Rates vary from company to company and from state to state. The best way to compare car insurance rates is to use an online tool or service that will help you compare quotes from different companies in your area.

When shopping for car insurance, it can be hard to figure out which rates are the best for your needs. To make the comparison more manageable, here are the top ten tips for finding the best car insurance rates:

- Compare car insurance rates online and get the correct quote for you.

- Know what you need coverage for. Make a list of the types of accidents and incidents that could occur while driving your car, and look at the different ranges offered by other insurers.

- Compare rates based on location and age of vehicle.

- Compare quotes from multiple providers.

- Use a calculator to estimate your monthly payments.

- Be realistic about your driving habits.

- Check your state’s minimum liability limits.

- Compare quotes from different providers and find the best deal.

- Compare quotes based on your driving history, car type, and zip code. Save time by getting a quote online.

- Consider adding an umbrella policy or rider to your existing policy.

Comparison shopping for car insurance can be a daunting task, but it’s essential to research to get the best rates for your needs.

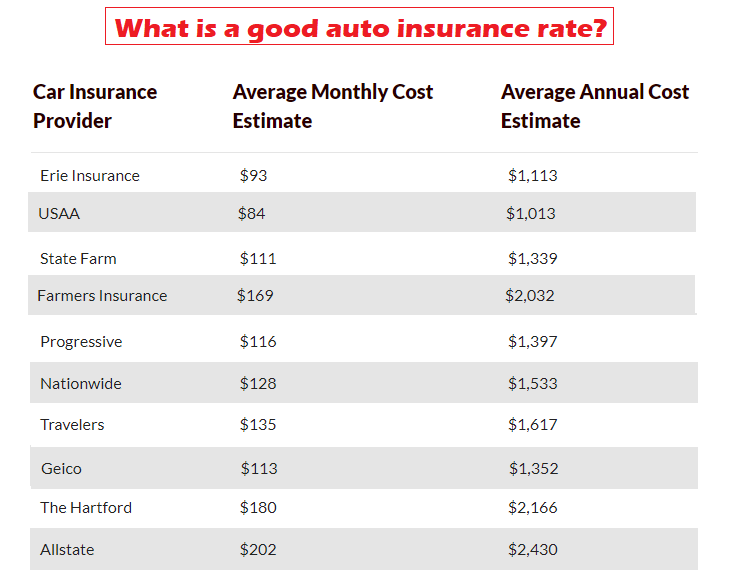

What is the Most Popular Car Insurance Rate?

According to a study, the most popular insurance rates among U.S. drivers are rates from the following companies:

Most popular car insurance rates As you can see, there are a lot of options when it comes to auto insurance. It’s important to know which companies you choose from, as that determines what you’re paying for. To help you compare rates from multiple companies, here are the most prevalent rates from the big three U.S. car insurance companies:

Which companies have cheap car insurance?

How to Find the Best Car Insurance Rate?

To find the best auto insurance rate, you’ll want to use the average rate from the companies listed above. The average rate should be close to the rate you were quoted when you bought your vehicle, but not exactly.

After all, some companies may charge more because they cover fewer miles, have a different policy on Bodily Injury, or have a different approach to calculating your rate. We recommend looking at at least two other quotes to get a sense of what your options are.

You can do a few things to find the best car insurance rate. Begin by looking at your driving record. A safe driver with no accidents will likely be able to get a lower rate than someone with multiple casualties. Next, consider your location and the rates for car insurance in that area.

Make sure you also consider factors like age, make and model of your car, and how well you drive. Finally, shop around and compare rates from different providers until you find one that meets your needs.

How to compare car insurance quotes?

Compare car insurance quotes from different companies. When looking for car insurance, it can be tough to figure out what quotes to get. There are so many different companies and rates, and it can be hard to know where to start. One way to compare car insurance quotes is by looking at each company’s coverage. Some companies may have more comprehensive coverage than others, so it’s essential to compare the options before deciding.

Comparison shopping for car insurance is necessary for getting a good deal. There are a few things to consider when looking at car insurance quotes:

- Your driving record

- The types of coverage you need

- Your deductible and premium

- The age and make of your car

All of these factors will affect the price of your policy. To get the best deal, comparing quotes from multiple providers is important.

- Recommended Reading:

- Yandex Games Unblocked.

- How Old Would Tupac be Today.

- Shipping to Amazon FBA Rapid Express Freight.

- How to Play Gartic Phone Game.

- The Best Cheap Car Insurance Near Me.

Why do you need to compare auto insurance quotes?

When looking for car insurance, comparing quotes from different providers is essential to get the best deal. One way to do this is to compare auto insurance quotes. By doing this, you can find out what rates insurers offer for similar coverages and see if there’s a better deal.

Another reason to compare auto insurance quotes is to ensure you’re fully covered. If you have multiple policies from different providers, comparing coverage is essential to know which approach has the best coverage for your needs. Additionally, shopping can help keep your premium costs down by finding an insurer with better rates or coverage.

The 3 Biggest Mistakes You’ll Make When Chasing Auto Insurance Rates.

Unfortunately, there are a few things you should probably avoid regarding auto insurance. Here are the biggest mistakes you’ll most likely make when trying to find the best auto insurance rate:

Mistake 1: Getting Negotiated on Your Rate You won’t get a reasonable rate by showing up with a price quote and a checkbook. You’ll almost definitely be offered less than you think you’re worth. This is especially true if you’re used to getting good value out of their insurance. Negotiate like you mean business, and don’t be afraid to ask for what you think is fair.

Mistake 2: Not Knowing Your Exact needs Your car insurance coverage should match your driving needs. For example, if you don’t drive off-road, then your car insurance coverage should stay the same as someone who does. However, if you drive on-road a lot, your car insurance company may go up slightly. We recommend checking out our list of the most popular car insurance rates in the USA to determine your best option.

Mistake 3: Being Overly Polite Your insurance company will decide how your rates go up or down depending on how you use your car. Be sure to be polite with the rep when you’re shopping around rates. Be sure to thank them for the information they’ve provided and let them know how you like things organized with your policy.

How to Calculate Your Ideal Car Insurance Rate?

Car insurance rates can be pretty complex, so it’s essential to have accurate information before making a decision. To calculate your ideal car insurance rate, you need to know your driving history, vehicle and liability coverage needs, and the state you live in.

Next, you can use an online car insurance quote tool to get a personalized estimate of your premium. Finally, compare prices and choose the policy that best suits your needs.

The best way to get a reasonable rate is to use our auto insurance rate calculator to estimate your savings. Once you’ve calculated your savings, you can compare different companies’ policies and see what you’re offered. But be sure to consider all the factors mentioned above so you can get yourself a good deal.

The Most Important Factor in Choosing Your Auto Insurance Rate

The most important thing you can do is get yourself a reasonable rate. Here are the things you should keep in mind when deciding on your car insurance rate:

Age: Your auto insurance rate should be higher the older your car is. This is because you’re more likely to have accidents as you age, and your risk of causing one increases. It’s also worth noting that some insurers will raise your rates if you have a history of impaired driving.

Gender: If you’re a man, you should probably pay more for car insurance than a woman. This is because insurers try their hardest not to discriminate against certain risk groups. However, there is some dispute as to whether this is the case. Some studies have shown that the average rate for male drivers is higher than that of female drivers.

Mileage: According to one study, you should pay more for car insurance if you’ve driven your car for less than ten years. This is because your body will be used to driving, and your insurance company will need time to adjust your rate. Controlling Your Rate One way to manage your rate is to ask for a lower rate when you’re first shopping around.

However, make sure you call your insurance company and ask for a lower rate first, then switch to the lower rate. It will save you the trouble of having to go back to them later on.

Conclusion

The best way to car insurance compare rates is to go online and look at rates from different companies in your area. By doing this, you’ll be able to see how much car insurance is in your price range and compare different companies’ policies.

The best car insurance rates are usually the lowest rates available and will give you the best value for your dollar. To get the best rates on car insurance, look into different companies in your area to see which one you can get a better deal on.

[hurrytimer id=”6075″]

Hello! Do you use Twitter? I’d like to follow you if that would be okay. I’m definitely enjoying your blog and look forward to new posts.